India's Strategies to Overcome Semiconductor Supply Chain Challenges

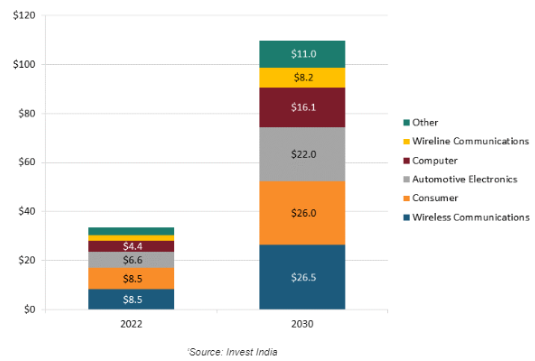

India’s rise in the semiconductor industry is fueled by strong reasons and smart plans. In 2022, India’s semiconductor business was worth $27 billion, but 90% of what it needed was imported. Yet, with a big demand for electronics, cars, phones, and more, India’s semiconductor market is expected to hit $55 billion by 2026, growing at an impressive rate.

To support this growth, the Indian government is investing $10 billion to enhance semiconductor capabilities, aligning with global demand and fostering job creation and economic expansion.

In this article, let’s delve into the supply chain challenges India may encounter as it navigates its way through this transformative journey.

Industry Landscape and Hurdles

India began its semiconductor journey in the 1980s with initiatives like Semiconductor Complex Limited (SCL) in Mohali. Despite early promise, challenges such as infrastructure limitations and skill shortages hindered progress. However, recent years have seen significant investments from domestic conglomerates like Tata Group, marking milestones in semiconductor production.

India’s Semiconductor market 2022(actual) and 2030(forecast in billion USD)

Government Support and Private Investments

Recent government approvals for semiconductor facilities in Gujarat and Assam, including Tata Group’s $10 billion investment in Gujarat’s Dholera, underscore India’s commitment to semiconductor advancement. Partnerships with global leaders, like Tata Electronics’ collaboration with Taiwan’s PSMC, bolster India’s position in the global semiconductor landscape.

Addressing Supply Chain Complexities

Raw Material Procurement

Securing a reliable supply of materials, including silicon wafers and specialized chemicals, is vital for uninterrupted production. To mitigate risks, India needs strong global partnerships and local sourcing networks, particularly amid geopolitical uncertainties.

Equipment and Technology

Procuring cutting-edge equipment poses challenges due to cost and specialization. Strategic partnerships with manufacturers and fostering innovation are crucial. Addressing infrastructure constraints, especially in transportation and power supply, is essential for operational efficiency.

Logistics and Distribution

Efficient logistics are vital for timely product delivery. Improving infrastructure, optimizing transportation, and leveraging digital technologies enhance supply chain visibility. Compliance with environmental regulations is necessary for sustainable operations.

Government Initiatives and Collaboration

Recognizing semiconductor manufacturing’s strategic importance, the government is funding infrastructure development and incentivizing chip design and local manufacturing. Collaboration with global semiconductor leaders strengthens India’s ecosystem.

Future Outlook: Navigating Challenges for Sustainable Growth

Looking ahead, the semiconductor industry in India holds immense promise, driven by burgeoning domestic demand and advancements in emerging technologies such as 5G, IoT, and AI.

However, addressing supply chain criticalities remains paramount for sustainable growth. By prioritizing investments in infrastructure, talent development, and technology adoption, India can solidify its position as a key player in the global semiconductor landscape.

Conclusion

India’s semiconductor industry is on a growth trajectory, supported by government initiatives and private investments. However, addressing supply chain complexities is crucial for sustained competitiveness. As India progresses towards semiconductor self-reliance, navigating these challenges will shape its technological future.